Fill out the form to download the Cash Balance Guide

Thank You

Click the button below to begin your download, please contact us if you have any questions.

Cash balance plans can turn taxes into wealth.

This powerful tax strategy can help you convert more of your company’s hard-earned profits into retirement savings for you as a business owner.

How a Cash Balance Plan Works

There’s a huge tax benefit that likely no one has told you about. By maximizing your savings and tapping into additional plan features that multiply your tax benefits, you can save up to $100k or more on your tax bill. See why many successful business owners have added a Cash Balance plan to their company’s 401(k) program.

What is a Cash Balance Plan?

A Cash Balance Plan is a type of retirement plan that allows business owners to contribute up to $480,500 per year. It’s sometimes called a Cash Balance pension plan because it’s a defined benefit plan, meaning contributors are guaranteed a specified amount in retirement.

Why it’s Important?

A Cash Balance Plan allows owners to keep more of their profits and grow them tax-deferred. And because it’s a business expense, a Cash Balance Plan can significantly reduce a company’s business taxes. In fact, owners can fund a sizable portion of retirement savings using money they would have paid in taxes.

How Fisher\SMB™ Can Help

Cash Balance retirement plans can be complex and require a plan advisor with deep expertise. Fisher\SMB is one of America’s top advisory firms with experience helping many business owners set up and manage this sophisticated strategy.

Case Study

Cash Balance Plans for Business Owners

Interested in seeing how a Cash Balance plan might work in real life? Check out how a high-earning doctor, who’s both a business owner and employer, can use this IRS-sanctioned strategy to reduce her tax bill by more than $100k a year.

Download the Guide

What you need to know about Cash Balance Plans

Looking to dig into the details of Cash Balance plans? What you need to know to unlock huge savings is right here, from the benefits of this type of plan to the challenges of building and maintaining a Cash Balance plan over time.

Download our guide to learn more.

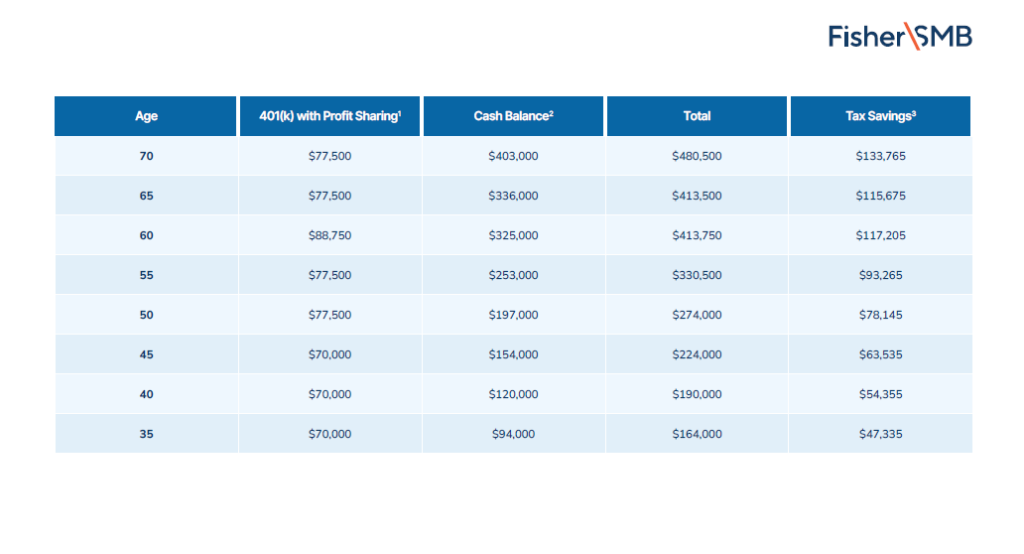

2025 Contribution Limits

Contribution limits typically go up each year, allowing you to save even more for retirement. Download this handy table to determine how much you can contribute to your own retirement, with and without applying a Cash Balance plan to your retirement program.

Frequently Asked Questions About Cash Balance Plans

Read some of the most commonly asked questions about cash balance plans.

A Cash Balance Plan can help business owners accelerate their retirement savings and realize

significant annual tax deductions, primarily because the annual contribution limits for a Cash Balance

Plan are higher than a 401(k) Profit Sharing Plan. For example, the annual maximum contribution for

a 401(k) Profit Sharing Plan is limited to $70,000 ($77,500 for age 50 and older) for 2025, while the

maximum contribution for a Cash Balance Plan can be as high as $480,500.

Cash balance plans are ideal for:

Business owners over 40

High earners (think $275K+ annually)

Companies with steady profits

Firms with fewer than 15 employees per owner

Owners who want to catch up on retirement savings fast

Contributions are tax-deductible for your business and grow tax-deferred. That means you lower your taxable income now and build wealth for later. Win-win. In 2025, the max you can put into a 401(k) with profit sharing is $70,000 (or $77,500if you’re 50+). But with a cash balance plan? You could contribute up to $403,000 depending on your age. That’s a massive boost to your retirement savings—and a big tax deduction for your business. Visit our Tax Savings webpage to learn more.

Here’s the deal: your business guarantees a certain return (the interest credit), so if the market underperforms, you’re on the hook to make up the difference. But if the market does well, your required contribution could go down. It’s a balancing act, but manageable with the right investment strategy.

Before you dive in, consider:

Can your business commit to annual contributions?

Are you okay with higher admin costs and complexity?

Do you have a trusted advisor or actuary to help manage the plan?

Learn more about

Cash Balance Plans and Tax Savings

12 Essential Cash Balance Questions

Learn how this hybrid plan work, who it’s for, and why pairing it with a 401(k) could be a smart move for your business.

Tax Strategies for Business Owners

There’s a huge tax benefit for businesses that no one may have told you about. Visit our Tax Savings page to learn more.

2025 Plan Comparison Chart

Use this handy chart to determine how much pre-tax money you can contribute to your personal retirement plan in 2025.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company’s retirement plan needs.

Call Us

(844) 238-1247