Roth 401(k) Guide

Thank You

Click the button below to begin your download, please contact us if you have any questions.

Boost your benefits with a Roth.

Everyone loves options. By adding a Roth option to your retirement plan, you give your employees the power to decide how to manage their tax benefits.

What is a Roth 401(k)?

A Roth option for your 401(k) plan allows you and your employees to contribute after-tax earnings toward retirement – and face no additional taxes on those savings or any investment earnings when the money is withdrawn during retirement.

How it Works

A Roth 401(k) allows employees to contribute to different types of accounts with different tax benefits; a tax-deferred 401(k) and an after-tax Roth account.

Why Offer a Roth 401(k)

Enabling employees to contribute to tax-deferred and after-tax accounts can reduce overall taxes paid over the life of the investment and increase retirement savings.

How Fisher\SMB™ Can Help

Fisher\SMB is one of America’s top advisory firms with deep experience helping business owners and employees utilize a Roth 401(k) to reap the benefits of tax diversification.

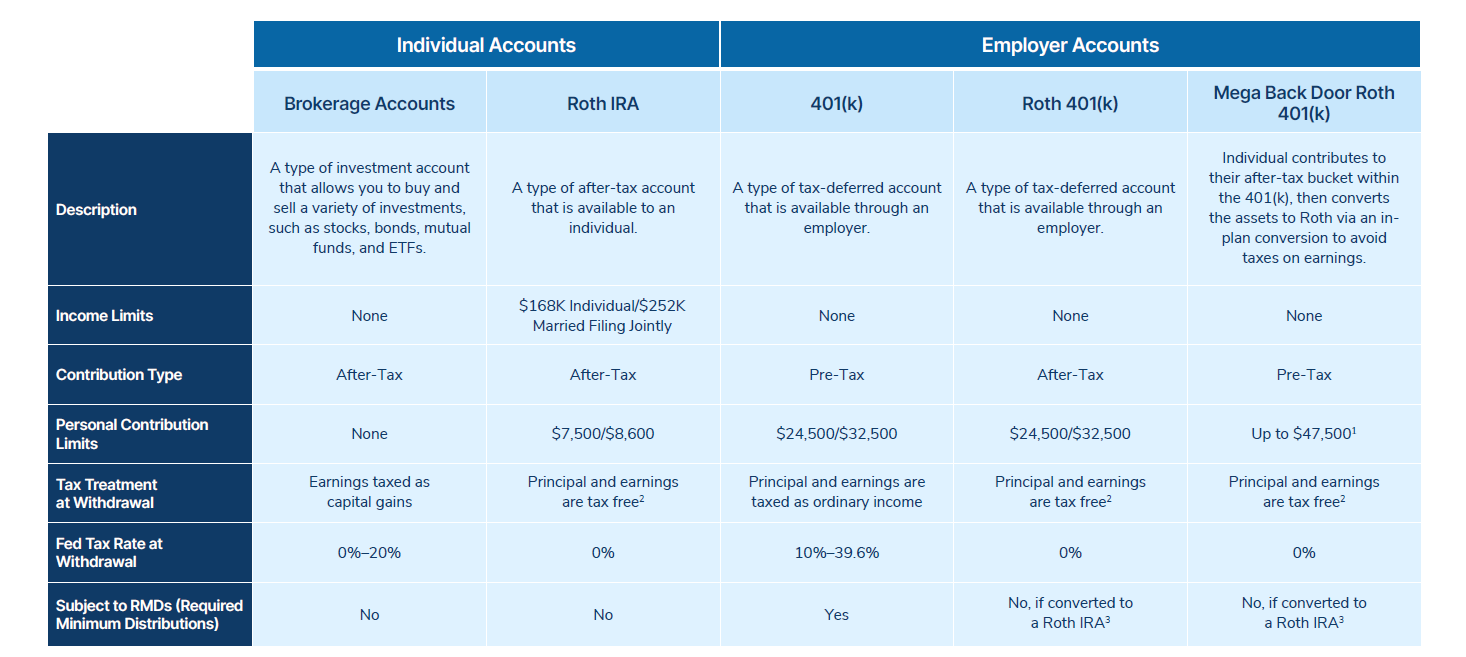

Downloadable Chart

Roth 401(k) Benefits

- Roth contributions grow tax-free.

- Roth assets enable tax diversification in retirement by creating a tax-free income option.

- There is no income threshold for Roth 401(k) contributions, making it the only tax-advantaged option for high-earners to create tax-free income in retirement.

Case Study

Tax Diversification

See how to leverage a Roth 401(k) to reduce taxes and increase retirement savings.

GUide

Roth 401(k)

You diversify your investment portfolio. It also makes sense to diversify your tax liability. Learn how employees can use a Roth 401(k) to create tax diversification.

Learn MOre ABOUT

Tax Diversification

5 Reasons Employees Love Roth 401(k)

A Roth 401(k) offers tax-free growth, higher contribution limits, and more flexibility in retirement. Here are 5 reasons your employees will love it—and why your company should offer one

How a Diversified 401(k) Can Cut Your Taxes

As a business owner, saving for retirement isn’t just about putting money away—it’s about doing it smart. And one of the smartest moves? Diversifying your 401(k).

Contact Us

One of our 401(k) business specialists would love to talk to you about your company’s retirement plan needs.

Call Us

(844) 238-1247