Tax strategies for business owners.

There’s a huge tax benefit for businesses that no one may have told you about. Some business owners can save up to $100K or more in taxes annually by using three IRS-sanctioned tax strategies.

Case Study

Tax Savings for Business Owners

Find out how a business owner can save more than $100K in taxes annually and turbo-charge her retirement savings.

guide

Tax Savings for Business Owners

What you need to know to unlock huge savings. This guide features information designed to answer your tax savings questions.

must-watch video

Tax Mitigation Strategy for Business Owners

Watch this short video to learn how business owners can use IRS-sanctioned strategies to reduce their tax burden and turbo-charge their retirement savings.

| Visual | Audio |

|---|---|

| Tax Savings Fisher\SMB™ | [Upbeat music] |

| A man dressed in a suit speaks to the camera. A flyout in the lower left corner identifies him as Matthew Cooksey, Business Development Team Leader. | [The volume of the music is reduced] Male Voice: A lot of small business owners don’t realize how much they’re missing out on tax advantage savings. You might be one of them. A tax strategy is a tool that small business owners can use to mitigate how much they pay in taxes and potentially increase how much they’re saving for retirement. |

| The camera zooms in as the man continues to speak. | An optimal tax strategy, utilizing the retirement plan can help business owners save upwards of a hundred thousand dollars on their taxes each year. |

| The camera zooms back out. | Fisher specializes in helping business owners leverage their retirement plan to reduce their tax liability. |

| The screen turns white, and the text “Our Tax Mitigation Strategy?” appears. It fades out and is replaced by the outline of a cake with 3 multi-colored layers with progressively smaller sizes from bottom to top. Each layer is labeled. The largest layer at the bottom is labeled 401(k), the middle layer is labeled Profit Sharing, and the top layer is labeled Cash Balance. The words “Three Layer Cake Strategy” are displayed above the cake. | For example, a tax mitigation strategy we often deploy for high earning business owners is our three-layer cake strategy. |

| The camera focuses in on the first layer of the cake, and the other two layers fade out. | In layer one, the owner should maximize their personal retirement plan contributions. |

| The text “$31,000” appears above the cake and then disappears. | This is important because these contributions reduce the owner’s taxable income dollar for dollar. |

| The second layer labeled “Profit Sharing” fades in and becomes the main focus. | With layer two, the owner should maximize their retirement contribution they receive from the company. |

| $77,500 appears above the cake before disappearing. | This can add tens of thousands of dollars to the owner’s retirement savings and it’s a tax reducing business expense the owner gets to keep. |

| The top layer of the cake (labeled “Cash Balance”) fades in, and becomes the main focus. | With layer three, add a cash balance plan. This is done in order to defer income beyond the limits of a typical 401(k) and profit sharing plan. Contributions are tax deductible, so they reduce business taxes and personal taxes, and they grow tax deferred. |

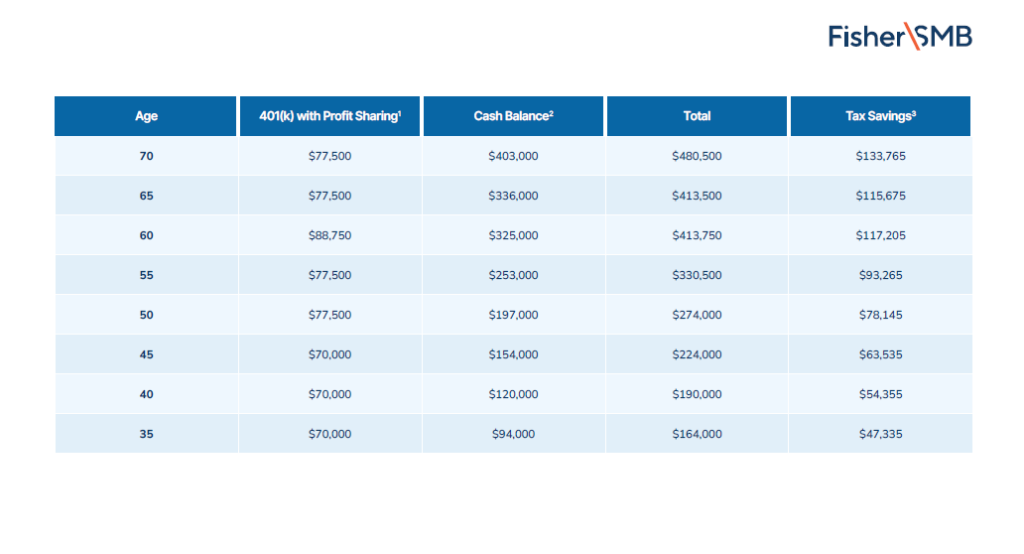

| The text “$480,500” appears above the cake and then disappears. | In some instances, this can be hundreds of thousands of dollars more in retirement savings for the business owner, |

| The text “$133,765” appears above the cake and then disappears. | And as I mentioned before, for some clients, this can save them a hundred thousand dollars or more in taxes each year. |

| Fisher\SMB™ dissolves on screen. | Navigating this complexity takes professional guidance. |

| Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants. Fisher Retirement Solutions™, Fisher\SMB™, FisherSMB™, and all related logos and designs are trademarks of Fisher Retirement Solutions, LLC, which is not connected to Fisher Investments. ©2025 Fisher Retirement Solutions | The volume of the upbeat music increases. |

| Music fades out. | Screen fades to black. |

Downloadable Chart

Plan Comparison

Use this handy guide to determine how much pre-tax money you can contribute to your personal retirement plan.

Learn MOre About

Tax Savings Strategies

Types of Profit Sharing Plans

Profit sharing in a 401(k) helps small businesses reward employees, attract talent, and cut taxes. Learn how it works, types of plans, and how to set it up—all in plain English.

How a Diversified 401(k) Can Cut Your Taxes

Learn how a diversified 401(k) can help small business owners cut taxes and boost retirement income. Simple breakdown with real-life examples.